Improving your building’s energy performance not only saves you money by reducing energy costs, it may also qualify you for a significant tax credit. The Energy Policy Act of 2005, signed into law by President George W. Bush, provides a tax deduction for energy efficient buildings via Section 179D of the Federal Tax Code.

179D enables owners of commercial buildings to claim a tax deduction for installing energy performance systems that meet certain criteria. Qualifying systems include high performance HVAC systems, energy efficient lighting and building envelope upgrades.

In some cases, qualifying for the 179D tax deduction is a relatively small investment that can yield a substantial ROI. Interior window retrofits, for example, are one of the most cost-effective ways to improve building envelope energy efficiency. Unlike expensive upgrades like traditional window replacements, Thermolite’s secondary interior window retrofit installs on the inside of a building’s existing windows. This not only eliminates the costly need to replace any glass, but also speeds up the installation process and minimizes office downtime. Most importantly, Thermolite’s window system has been repeatedly proven to reduce annual energy costs by upwards of 20%, easily exceeding the 10% threshold required by 179D.

179D Tax Deduction Requirements and Benefits

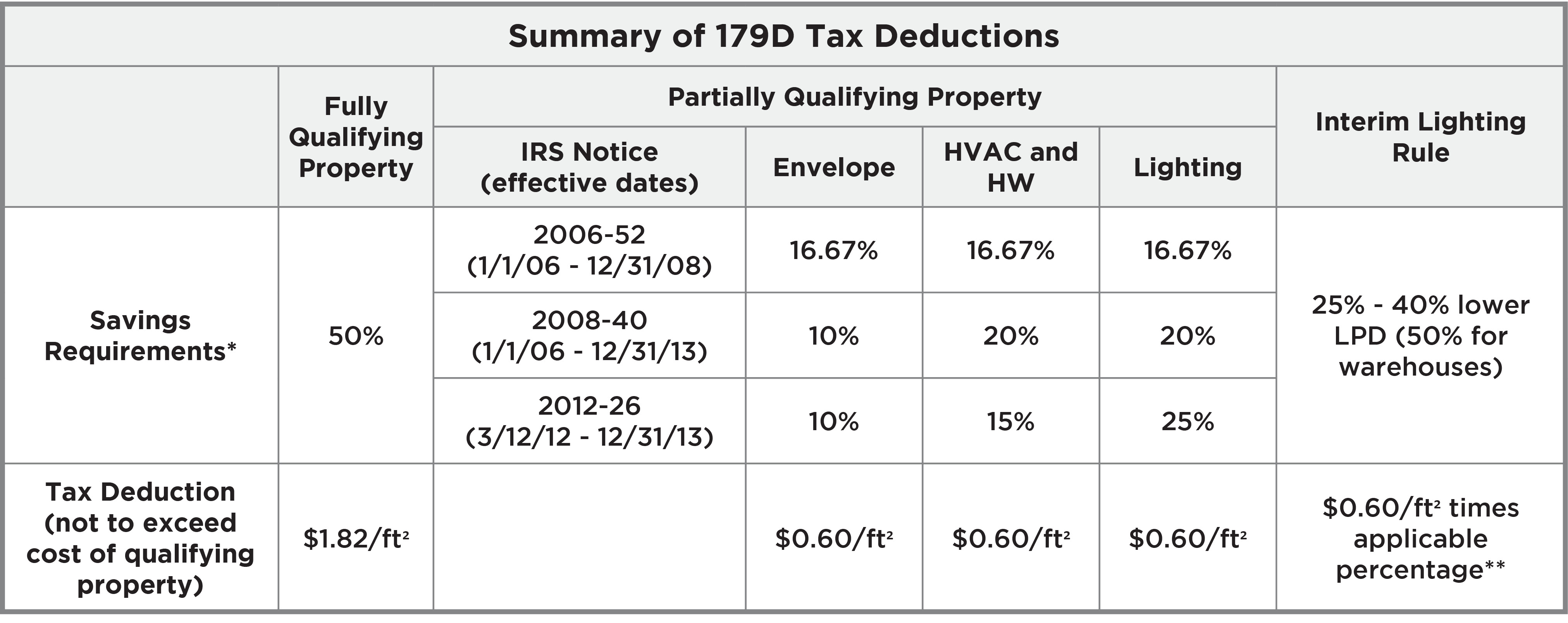

In order to qualify for the 179D tax deduction, your energy performance system must have been installed by December 31, 2016. The maximum deduction allowed under 179D is $1.80 per square foot. To be eligible for this, your HVAC, lighting or building envelope upgrade must be shown to reduce your building’s total energy and power cost by 50% or more in comparison to a building meeting minimum requirements as set by the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE). That said, you can still qualify for partial tax deductions if your systems meet certain energy savings parameters. The two tables below summarize the 179D tax deductions and how much you can expect to save if your building is eligible.

179D Department of Energy Calculator

The DOE provides a convenient online calculator to make it easier for you to find out if you qualify for the 179D tax deduction. All you have to do is enter several key characteristics about your building including the gross floor area, number of floors, aspect ratio, window-to-wall ratio, and plug-load density, as well as information about your HVAC, lighting and building envelope.

Presuming the type and configuration of your building is applicable (buildings with complex HVAC systems and/or high internal loads are ineligible), a DOE Calculator Results Report will be provided as documentation of the qualification and eligibility status. You will still need a certification of the property performance from a licensed contractor or engineer in order to receive the tax deduction. Learn more about the 179D DOE Calculator.

The Uncertain Future of 179D

The 179D tax deduction has been in effect since January 1, 2006 and expired on December 31, 2016. This has many building owners, ESCOs, engineers and architects anxiously awaiting whether or not congress will extend the bill like President Obama did when he signed the Protecting Americans from Tax Hikes (PATH) Act in 2015. Many are optimistic that a similar extension will take place sometime this year. Currently, there are three bills in the House of Representatives that would extend 179D:

- H.R. 6360 would amend the Internal Revenue Code of 1986 to extend the credit for energy efficient commercial buildings for one year (Sponsor: Rep. Alan Grayson).

- H.R. 6361 would amend the Internal Revenue Code of 1986 to extend the credit for energy efficient commercial buildings for two years (Sponsor: Rep. Alan Grayson, Alan).

- H.R.6376 would amend the Internal Revenue Code of 1986 to modify the energy efficient commercial buildings deduction, and for other purposes (Sponsor: Rep. David Reichert).

Additional Resources:

Energy Savings Modeling and Inspection Guidelines for Commercial Building Federal Tax Deductions, published by NREL, provides guidelines for the modeling and inspection of energy savings required by the statute prior to 2016. View the full PDF.

Energy Savings Modeling and Inspection Guidelines for Commercial Building Federal Tax Deductions for Buildings in 2016 and Later provides updated guidance for modeling and inspecting energy-efficient property in commercial buildings as enacted by the Protecting Americans from Tax Hikes (PATH) Act of 2015. This document applies to buildings placed in service on or after January 1, 2016. View the full PDF.